Maybe you’ve just put your Christmas decorations away or maybe you still have them up. (I do, I’m avoiding it) But to create a financially stress free Christmas you need to start saving now. Start saving now to avoid using credit cards, start saving now to avoid overdrafting your account trying to squeeze gifts in, save now so you’re not so stressed later.

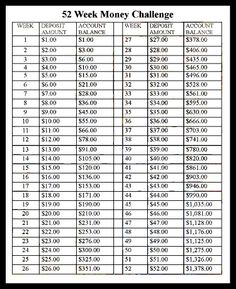

You might have seen the weekly Christmas savings plan that’s floating around on the internet:

Here’s my issue with this challenge. Actually I have several issues. IF you are actually on a budget or living paycheck to paycheck, in theory, this sounds like a great idea. So you start saving $1 in saving the first week, $2 in savings the next week…hey this is easy right? Ok well then you get to about week 30 and you’re putting $30 a week away. If you get paid biweekly, that’s $60 per pay, $120 per month! If you’re living paycheck to paycheck or already putting money in savings for a safety net (as you should) then this is unrealistic. Then you come down to week…i don’t know 46, 47 where you’ve probably started shopping for Christmas with black friday and cyber monday. Who can put $50 a week away when you’re already buying Christmas gifts? I mean if you can, good for you, but you probably have a little more free flow with your money than others.

So I’ll tell you what I do. As a mom of 4 living the frugal lifestyle. As soon as I finish my Christmas shopping whether it be Black Friday or Christmas Eve, I start putting money back into my holiday club to start replenishing for next year. I get paid biweekly so I put anywhere from $5-$20 per paycheck away, EVERY paycheck. Whatever I can afford to take out of that paycheck and still pay bills and have some fun and incidentals money. If you get paid weekly try putting $5-$10 a week away. If you get paid monthly try putting $20-$30 away per pay. Then, Any other non-paycheck money that comes through such as tax returns, winning money on a scratch off, put a percentage of that away too.

If you put $20 a month away until November That’s $220

IF you put $30 a month away until November that’s $330

If you put $40 a month away until November that’s $440

Then if you put other money away for example you get your tax return and you put $100 of it away you can add $100 to your total. Say you won $60 at a football game for their 50/50 you can put $20 of that away. If you get a holiday bonus you could put 20% of that away, etc. You can see where you can build on your savings. Depending how much you spend on Christmas the monthly amount might be enough for you.

Everyone’s financial situation is different, put what you can away. You can actually use this idea for your safety net savings as well.

really? there are people who spend this amount of money on one day? What a waste

To each his own. Some people don’t spend anything some people set a budget, others go overboard. For anyone that does do Christmas gifts, there are ways to budget. I know people that talk about buying their kids things like quads and macbooks for Christmas. Those things are out of my budget personally. If you don’t do Christmas gifts I respect that.