**This post is brought to you by MyJobChart.com**

I wasn’t always the bargain hunting momma who refuses to use credit unless she has to. No, I was the know-it-all kid who was going to college. When I got out I’d have a good job and could easily pay the minimum balance on a few credit cards. I know, that whole sentence just sounded like the lit fuse to a financial bomb right? That was in fact, what it was.

I grew up the eldest of 4. We never had a lot of money. Don’t get me wrong, we had our needs taken care of and a few fun things now and then but we never had the name brand things or the newest things. I wanted that so bad. I got a waitressing job in high school. I had no bills so I spent my money as I pleased, putting only a small percent away for college. I got to college, got a job making my own hours at my apartment building’s gym. $300/mo, still really no bills to speak of. Then they had the Pittsburgh Regatta. My friends and I went to have some fun. There were at least 3 credit card companies with tables set up. Sign up for a credit card get a free basketball, sign up for a credit card get a free cooler. Free stuff sounded good to a college kid. I never thought I’d get accepted anyway making only $300 a month. Well I did get accepted, for all three.

Fast Forward to me getting married to my college boyfriend (who also applied for cards to get free stuff). In over our heads in debt, stressed out, and on the brink of divorce. (Not because of money mind you but because of a cheerleader, but that’s a whole other story). We ultimately did divorce but declared bankruptcy before we did. I became a single parent with 2 kids, living with my parents, and drowning in debt. Paying for an attorney, phfft, I may as well of handed him my paycheck. Debt collectors calling me because they were going nowhere trying to talk to my ex. I talked to them. I told them my story, they let me make payments. That’s the short version. I’ve been paying off my debt ever since. Even the joint debt from my 1st marriage with no help from him at all. Well I could sit here and complain but that won’t fix my credit right? I’ve paid off almost all the debt now. I still have a few things left I’m paying on but in about 2 years it should be gone. All this is the reason I’m so passionate about saving money and sharing deals. My story is why I have this blog. I started reading things from money magazines, and debt gurus like Dave Ramsey and others. Finding things that worked for me.

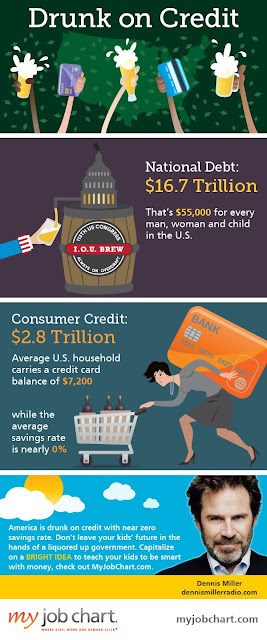

I talk to my kids often about money. They get an allowance but they have to work for it. I encourage them to save for bigger items with opportunities to earn extra for more work. I discourage them from borrowing money but if they need to, I hold them accountable to pay it back. I get excited about deals and tell my kids why something is better to buy than another option or why it’s better to wait. My oldest son is already showing signs of being a bargain hunter. I’ve even rubbed off on my current husband, though he is much better than I ever was with money. My husband and I both learn all we can about debt and options.

It feels so much better to pay off debt and not have things looming over your head. It feels good to know that I got something for half the price that someone else did and paid for it cash. There are ways to get kids excited about using money correctly. With no guarantees in the job market and government changes, kids really need to learn how to handle money.

I keep stressing to my 13 year old that he should offer to mow lawns, weed eat, and do other small tasks to make a few extra bucks to put back for college but he doesn’t completely understand that concept yet. He knows his dad and I are having a hard time with money right now but he has never had expenses or bills so he can’t imagine what we are talking about.

He wants to go to OSU and if accepted it isn’t cheap and I can help him out if he absolutely needs it but that will be his debt to pay. I really wish I could be one of those parents who pays their kids way through college but I can’t.

I don’t even like saying this but I have about $6000 in credit card debt and other things I’m financing and that’s not including my car. I know some people have more but I want to take control of my debt before it gets too out of hand.